Frank Sonnenschein moderated at Hydrogen Expo North America, Houston TX, which took place on June 25-26th 2025. Ahead of his participation at this year’s event, we spoke to Frank about a topic that could be of great interest to attendees - How hydrogen technology can contribute to grid resilience.

Grid Balancing and Renewable Energy Integration

Q: How do dynamic operation capabilities of PEM fuel cells (PEMFCs) and PEM electrolysers (PEMELs) support grid balancing and renewable energy integration compared to the more static operation of alkaline water electrolysers (AELs)?

Frank Sonnenschein:

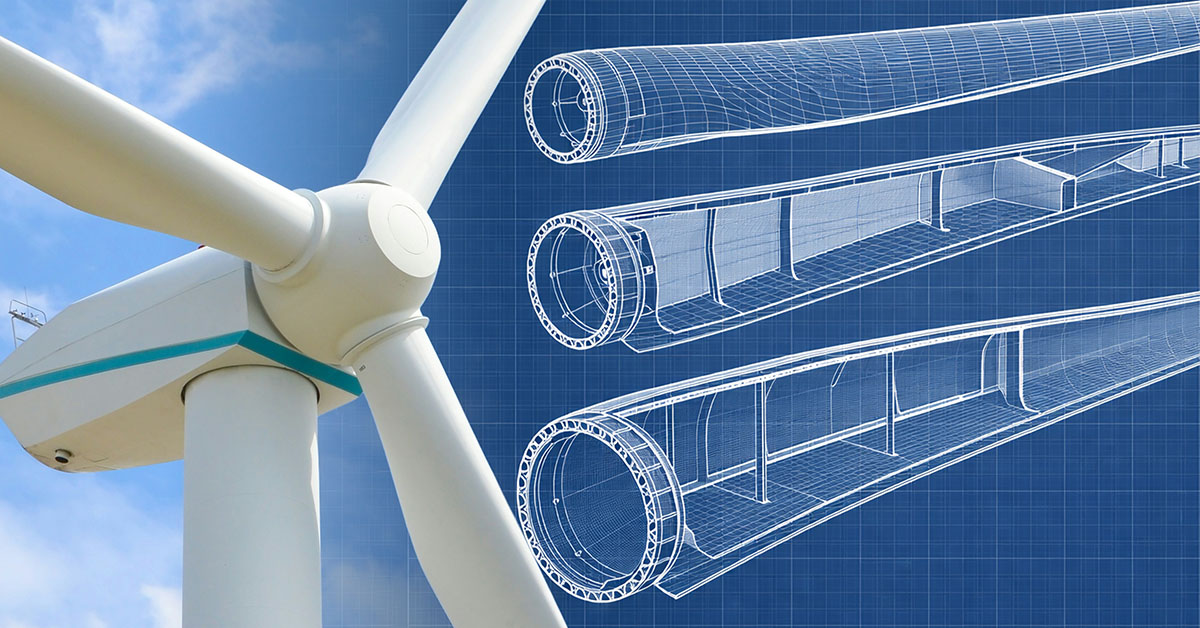

The AEL is very good for general turnover from fossil fuel-based energy to more solar and wind-based energy. They are suitable for large scale operations, have relatively good efficiency, and can effectively transfer and store energy. The downside of AEL is that they are in general less agile than PEMELs. AEL usually need significantly more time to start and stop operation. They are great for static, plannable power support, but have issues with unstable power input.

That is why, for support and balancing of the grid, PEMELs are, in my opinion, more relevant. This is because on a windy, sunny day, often more energy by solar and wind is generated than needed. That surplus can feed back into the grid, or as happens in Germany you can pay neighbouring countries like Poland to take this excess energy. In essence Germany pays Poland to take their energy as they have too much on the grid. Instead of getting paid for selling energy, they must pay to sell energy. This is inherently counterproductive.

With PEMELs, you can switch on and off more or less instantly. When the wind is blowing, you switch it on, and within minutes you start producing hydrogen. When the wind stops blowing or sun stops shining, it switches off and stops producing. It is very dynamic in that way and as a result is ideal for rebalancing.

For more on this topic, download our complementary White Paper:

Driving Decarbonisation: PEMFC, AFC, PEMEL & AEL Tech for Sustainable H2 Electrolysis

Technical Challenges in North America

Q: What are the main technical challenges when integrating PEM-based systems with intermittent renewable sources like wind and solar, especially in North America?

Frank Sonnenschein:

Firstly, the grid infrastructure is not quite ready yet. At this moment, a PEMEL can be purchased relatively easy, and it can be run, but what can be done with the hydrogen? There is no hydrogen transport infrastructure, picking up hydrogen and taking it to a centralised place. The infrastructure is simply missing.

Secondly, because quantities are still very, very low, prices remain quite high. Think of it like this. When I was young, the first 4x speed CD burner was 100€s, but now you get 64x speed capability for under 20€. This same economic scaling effect must happen for hydrogen to become commercially viable. Higher efficiency and reliability for significantly less money. That only can be achieved by people, companies, or states starting to buy and invest widely into hydrogen.

Thirdly, problems associated with scaling. For decades it has been relatively easy to manufacture three-cell or ten-cell stacks. But scaling up to a 120-cell stack or more, that is where the problems come. Leakage becomes an issue because there is no optimal gasket solution out there yet, e.g.

Another technical challenge is efficiency. To scale up, you need high efficiency. You achieve roughly 70% conversion rate from energy to hydrogen, and another 70% conversion rate from hydrogen to energy as a rule of thumb. So, if wind is blowing on the coast and hydrogen is produced, transported to my house, and converted back to electricity, I lose approximately 50% of the original wind-generated power. This is a real challenge. On the other hand, without that 100% of the energy is lost, as not being collected/stored. Having 50% used is better than having none of it captured.

Industrial and Mobility Applications

Q: In which industrial or mobility applications do you see the greatest demand for dynamic operation, and how would Versiv potentially address these needs?

Frank Sonnenschein:

Electric forklifts, for example – Amazon is the biggest private user of hydrogen forklifts in the US, with around 99% of their forklifts powered by hydrogen according to several news releases. We also see applications in backup power for remote locations like desert installations, and hospitals in urban areas. For instance, my local hospital in Erkelenz, Germany, uses hydrogen backup power since 2024. Usage is also increasing for light trucks, buses, and maritime vessels.

For Versiv, our solutions involve advanced materials for gasketing to prevent leakage. We also provide optimal substrates for decal transfer, enabling thinner catalyst layers. This is how we support these dynamic applications.

Q: How do the durability and efficiency trade-offs differ between dynamic (PEMFC/PEMEL) and static (AEL) technologies, especially for large-scale deployments?

Frank Sonnenschein:

Experience tells us alkaline tends to make more sense in large scale as it is often more efficient and durable and cheaper to build in large scale. They start at 10–20 MW, whereas PEMs are usually 1 MW and require stacking for higher capacity. For example, Rotterdam, they are building towards an 800 MW electrolyser and are currently operating at 200 MW. I believe PEMs are more for dynamic, flexible operation, but if you want to go big, alkaline seems to be the more common choice.

Advanced Stack Design and Sealing Solutions

Q: Can you elaborate on the role of advanced stack design and sealing solutions in ensuring reliable performance during frequent load changes in dynamic applications?

Frank Sonnenschein:

This is a strategic question. With 60% -70% efficiency as a baseline, you can improve performance through better design or advanced materials. Technically, we always strive for improvement, but economically, products must be commercially viable and proven in the market.

Chinese companies are ahead in mass production, but others are technically better. Versiv usually uses 5-10 materials at start, and we are always testing new samples. The company maintains a diverse product portfolio—we can select from this variety, then coat and laminate materials. Customers can choose from 5-10 different basic film options with various thickness combinations. This creates significant scope for product innovation through our R&D capabilities and customer support. Thanks to our inhouse R&D and huge experience we can react to customer test results and alternatives can be found quickly, if needed.

Market Trends: Europe vs North America

Q: What trends are you seeing in the European and North American markets regarding the adoption of dynamic vs. static hydrogen technologies?

Frank Sonnenschein:

Some customers implement both PEMEL and PEMFC technologies. Doosan, for example, uses both approaches and employs two different techniques: SOFCs and PEMFCs. There's a market for both technologies, depending on the application. In Europe, large projects like Rotterdam Port are implementing alkaline technology. In North America, adoption seems slower overall, but mobility and backup power applications are growing for PEM technologies. Latest market research forecasts a fair split of several fuel cell and electrolyser technologies, as all have their unique pros and cons.

Q: Looking ahead, what innovations in materials or system design could further enhance the flexibility and grid integration potential of PEM and alkaline technologies?

Frank Sonnenschein:

Gasket materials that offer rubber-like compressibility combined with PTFE-like chemical stability are crucial. We're working continuously on this challenge, always seeking improvements.

Q: Are you likely to speak about this aspect of the White Paper in Houston? What do you most enjoy about the event?

Frank Sonnenschein:

Yes, for sure. This is my first time serving as moderator and conference chair – I have been an attendee and speaker before, so it is exciting to be part of it in a different way. Also, we get to meet the speakers before and after and get a sense of the context behind their speech and to get a true market update. I am really looking forward to that aspect.

For example, I look forward to asking questions like - what we see as a delay, a drop in priority and delay in projects – is this worldwide or regional? How long will the slowdown be? Consolidation phase is vital for healthy market growth and hydrogen needs that consolidation. I am looking forward to interesting thoughts and building consensus around these critical issues.